Digital payment in Nigeria

- zabapay

- Nov 20, 2019

- 2 min read

Nigerians love their mobile devices. After years of steady growth, ownership levels of smartphones and tablets have remained steady since 2013. And in some demographics, mobile device ownership is at near-saturation. In 2018, the average user spent more than 2.5 hours on their mobile devices per day, with two-thirds of that time spent on smartphones.

Mobile devices have also transformed commerce experiences with both retailers and service providers. One of the most important elements of this transformation is the ability for consumers to make payments directly from their mobile devices.

In 2014, the Central Bank of Nigeria (CBN) released a statement indicating that they will be allowing mobile network operators to operate mobile money services. CBN had previously blocked network operators from getting licenses to move money for customers without using a bank. Although fintech companies in Nigeria have had the license to provide financial services since 2012, this move by the regulator to open up space to mobile network operators will not only bring co-opetation, it also has the potential to benefit the more than 140 million smart mobile phone users in Nigeria.

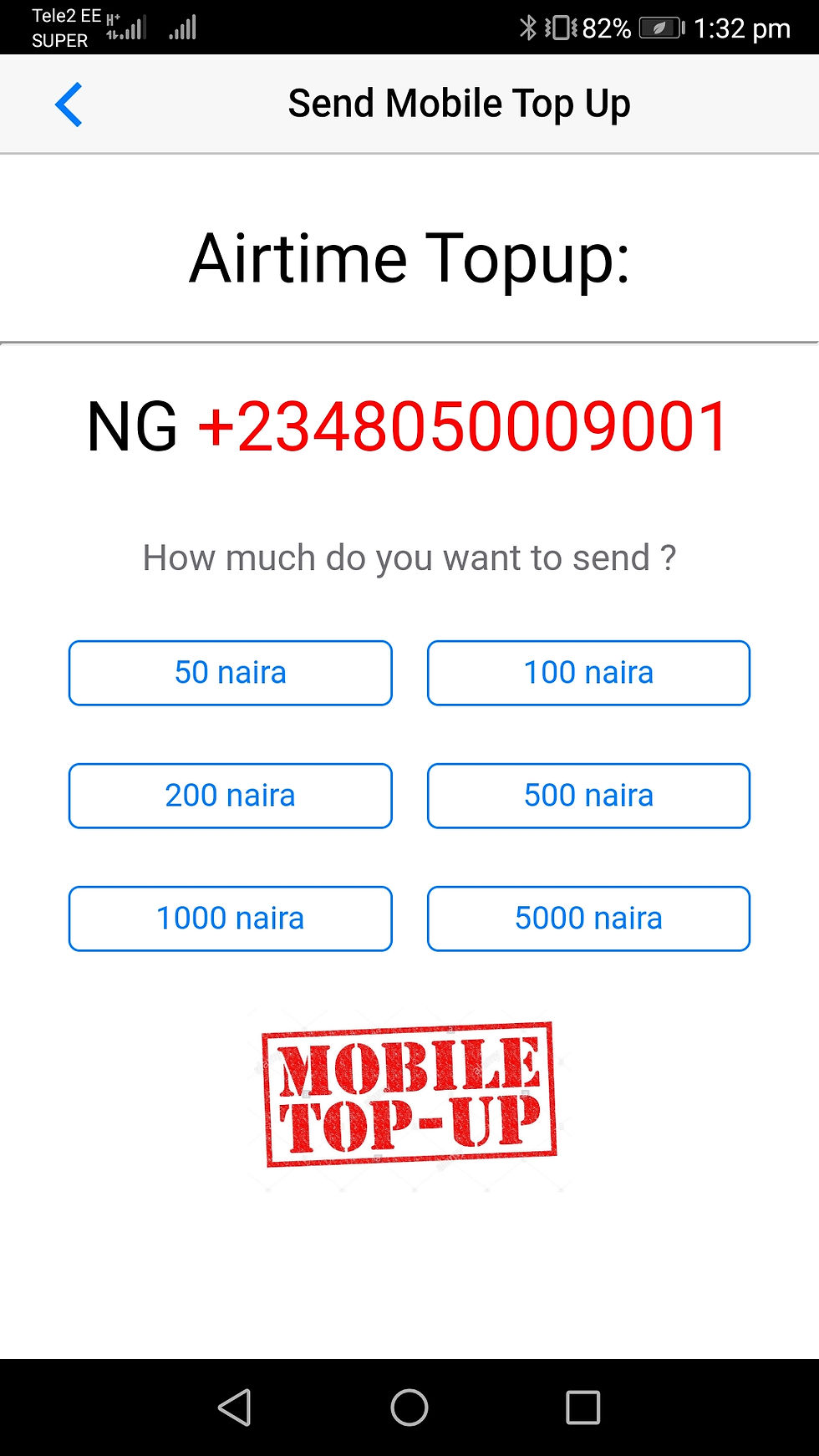

Simplifying bill payments is all about delivering a user-friendly experience to the channels that customers use most. Making payments with your smartphone is easier than ever with mobile payments apps providing consumers with new ways to exchange money, purchase products pay bills and manage expenses and earn rewards while doing all these fun activities.

Mobile payment apps are digital wallets, mobile commerce apps and peer-to-peer payment platforms

A standard mobile payment app should have these features regardless of their platform.

Person-to-person payments

In-store payments

Pay on online stores

Web interface

International Payments

Loyalty programs

Airtime purchase

Pay bills

Mobile internet dominates in Nigeria 85% of all internet subscriptions in the country are mobile, totalling at 120 million internet users. With that the growth potential for mobile payment is big with a country population reaching over 200 million. Currently about 18 percent of smartphone users say they use their mobile phones to pay for goods and services.

Written by JOHN CHSIOM IKE

Comments